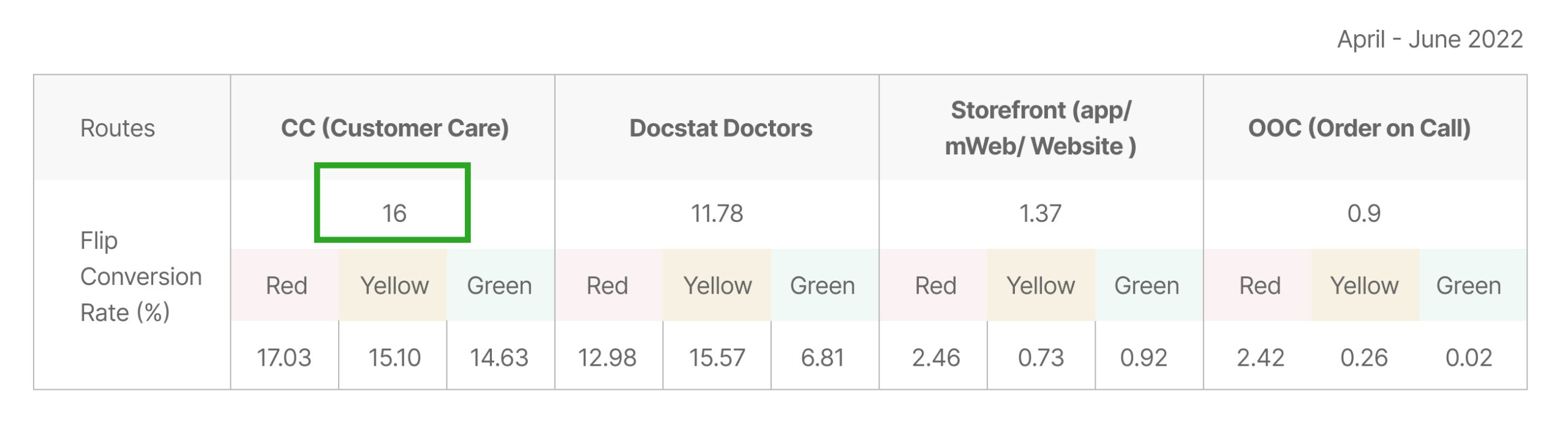

There was a low acceptance rate (1.37% in Apr-Jun 2022) of the alternative medicines proposed by PharmEasy on the storefront. This research aimed to understand user mindset and behavior, in terms of their perception, comprehension, key drivers, and pain points of Flip on PE.

The output was directions to the design, product, and operations team.

MY ROLE

Responsible for research planning, recruiting of participants, moderation, analysis, documenting, and reporting

THE TEAM

1 Product Manager, 1 Operations Manager, 1 Business Analyst, 1 Head Researcher, 1 UX Researcher, 1 UX Designer

TIMELINE

4 months (1 month of delay for data collection)

June-Sept 2022

ABOUT THE COMPANY

PharmEasy is India’s Largest Online Pharmacy Marketplace. It is a consumer healthcare “super app” that provides consumers with on-demand, home delivered access to a wide range of prescription, OTC pharmaceuticals, other consumer healthcare products, comprehensive diagnostic test services, and teleconsultations.

I have been part of the amazing PharmEasy UX Research Team for my Graduation Project Internship. During my time there, I grew as a qualitative researcher. My team helped me learn the core research skills and the processes as well as community engagement. We closely collaborated with design, product management, analytics and customer experience team.

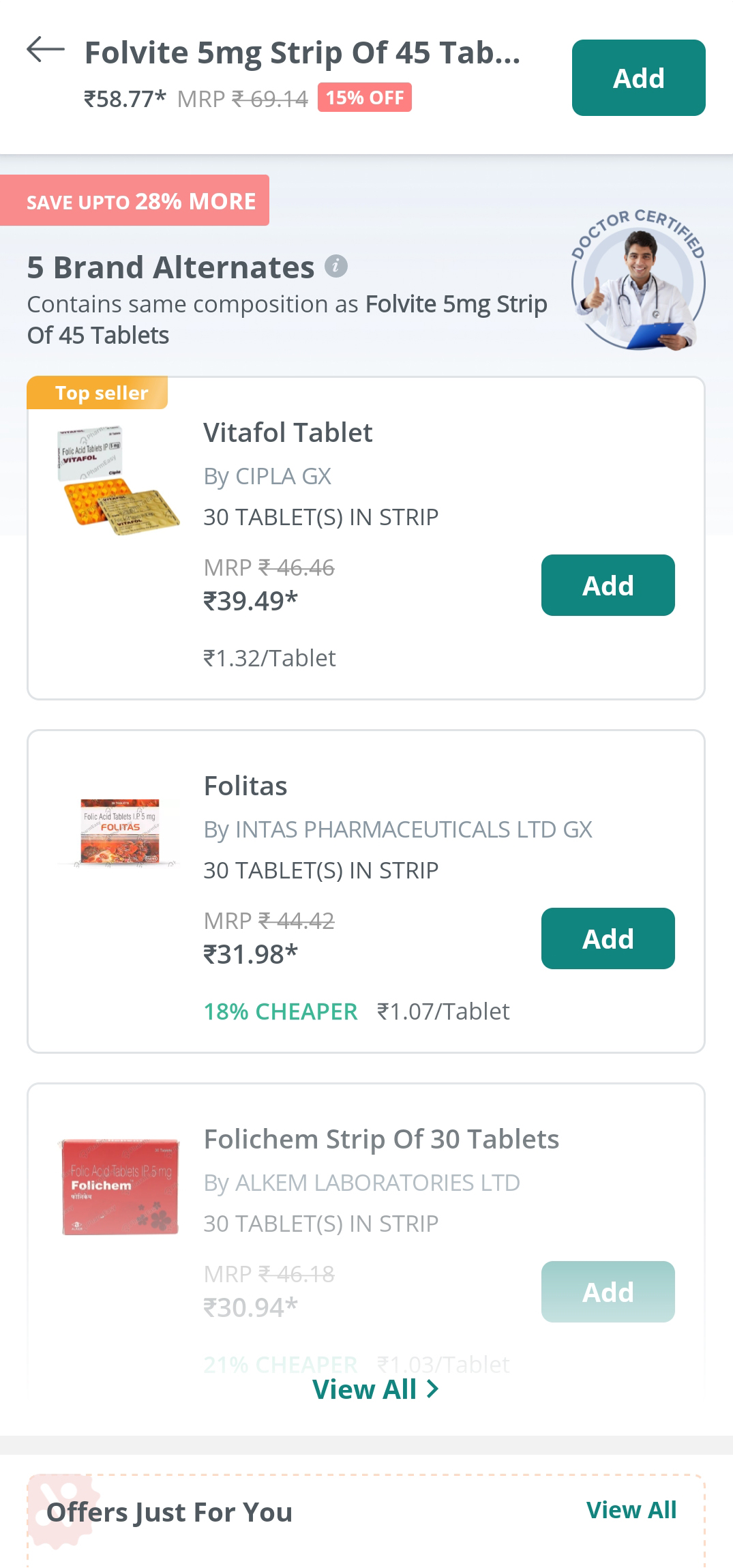

OVERVIEW OF THE FEATURE

About Flip

- Flip is a feature on PharmEasy through which company propose alternative medicines with the same composition as of original medicine to the users

- For two medicines to be flip of each other, it should have same

- Composition

- Dosage form

- Route of administration (ROA)

- Drug release mechanism (DRM)

- Therapy

- The product has been recently rolled out to all the users

- Earlier Flip used to solve the product availability issue for users. Now the company wants to improve its margin by selling “Brand Alternates”

- The section of Flip comes on the app as “Brand Alternates”

RESEARCH PROCESS

The entire research took place in two phases.

Phase 1: CC Agents & DocStat Doctors – (Interviewed 5 doctors & 5 agents) – 1 month

Phase 2: User Base – (Interviewed 17 PE users) – 2 months

ANALYZING RESEARCH PROBLEM

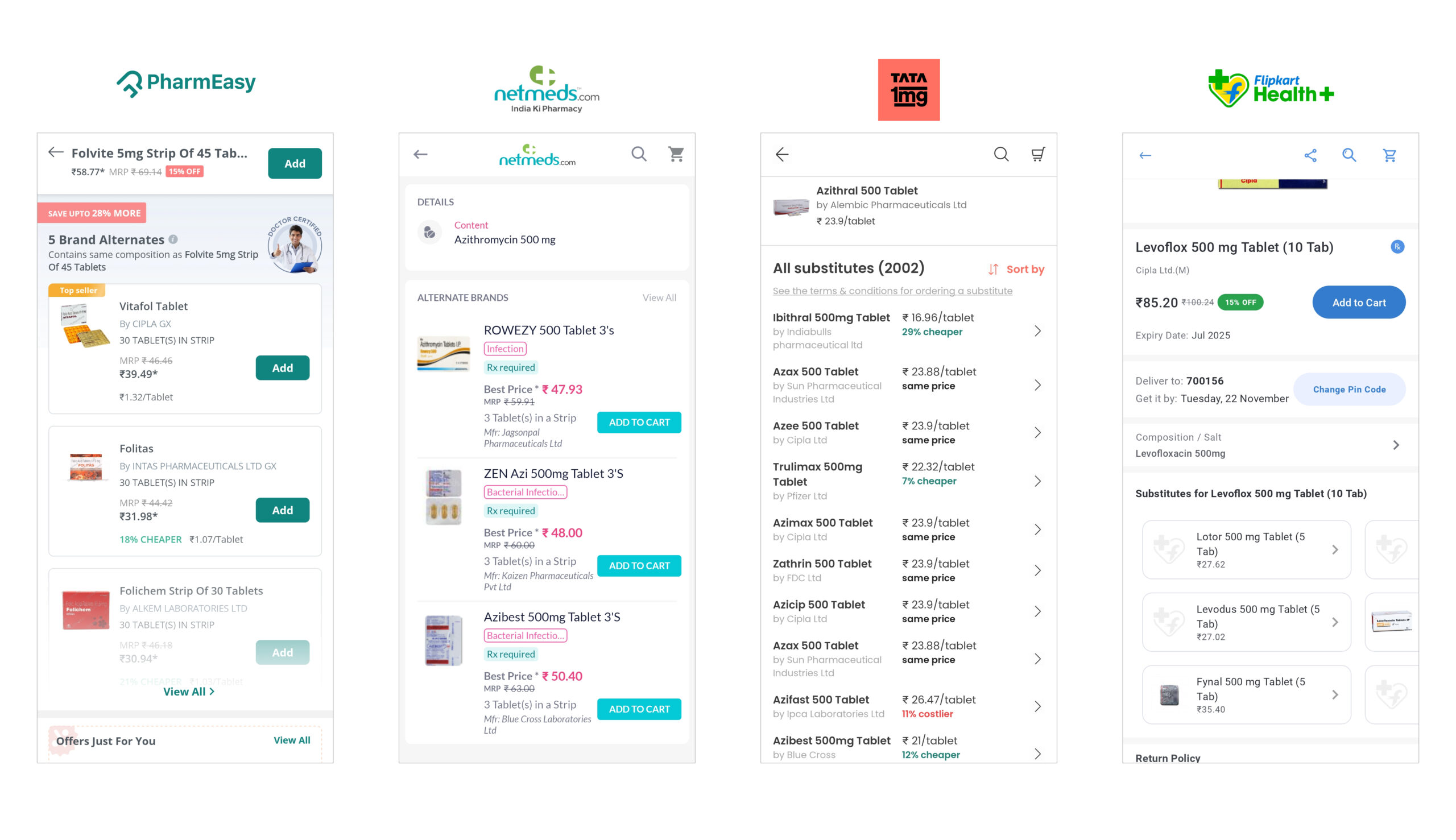

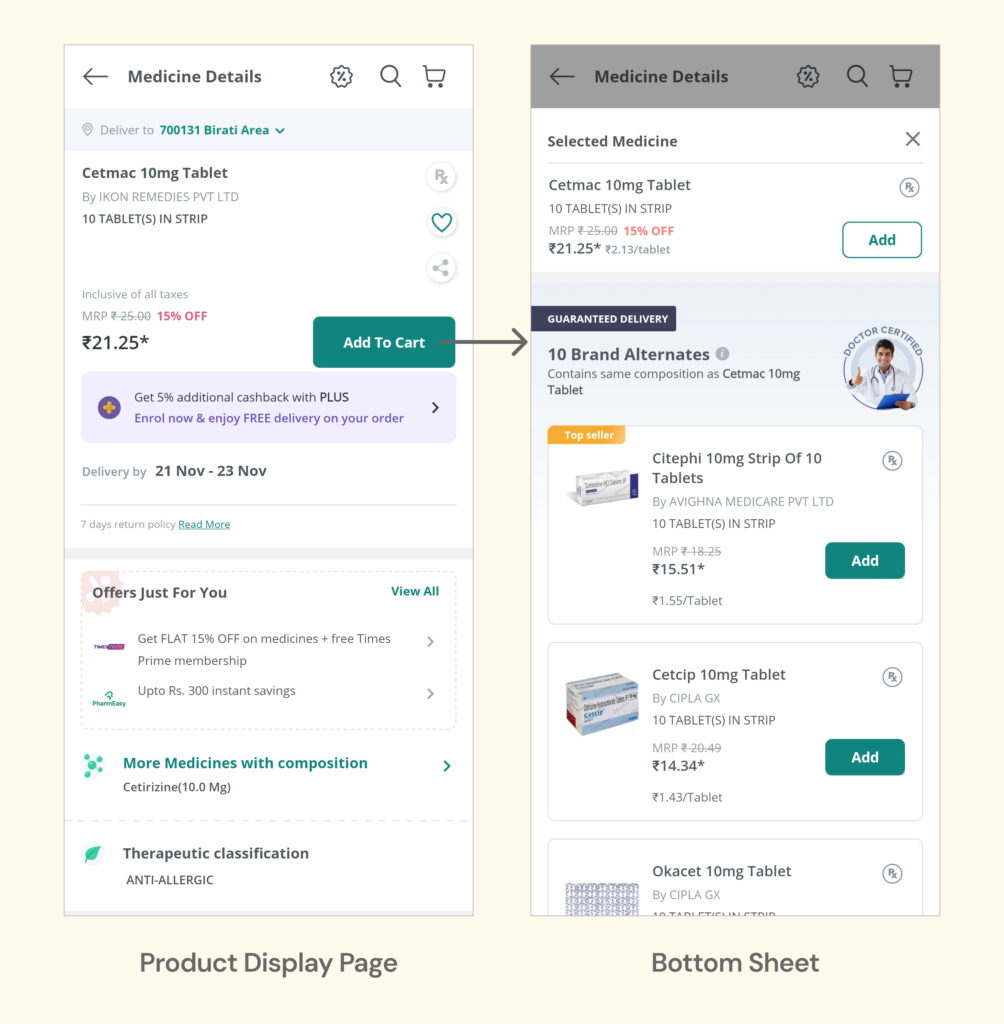

Industry Benchmarking

PharmEasy has all the desired specifications to make a choice for the substitute

Availability tiers of Medicine

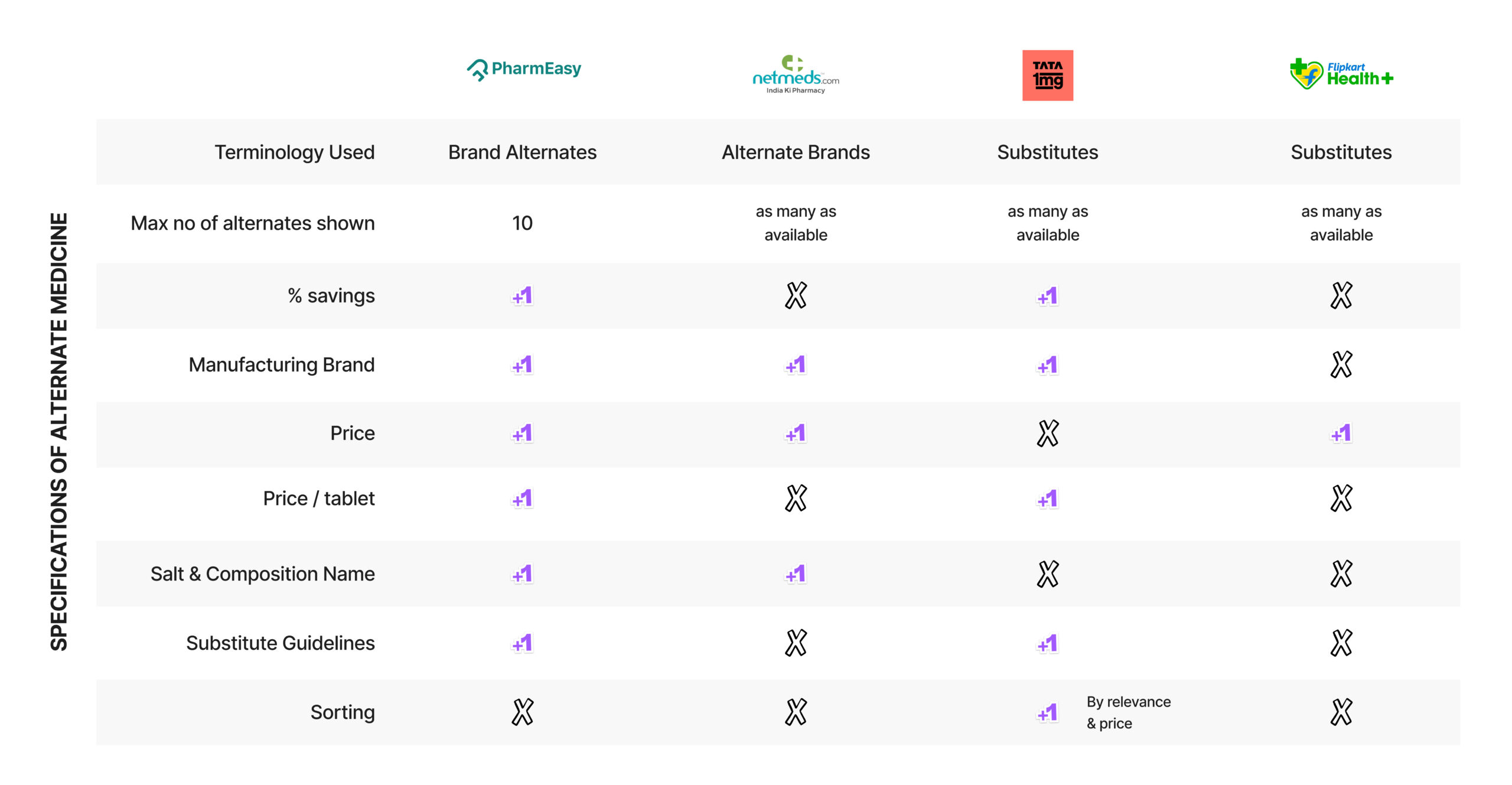

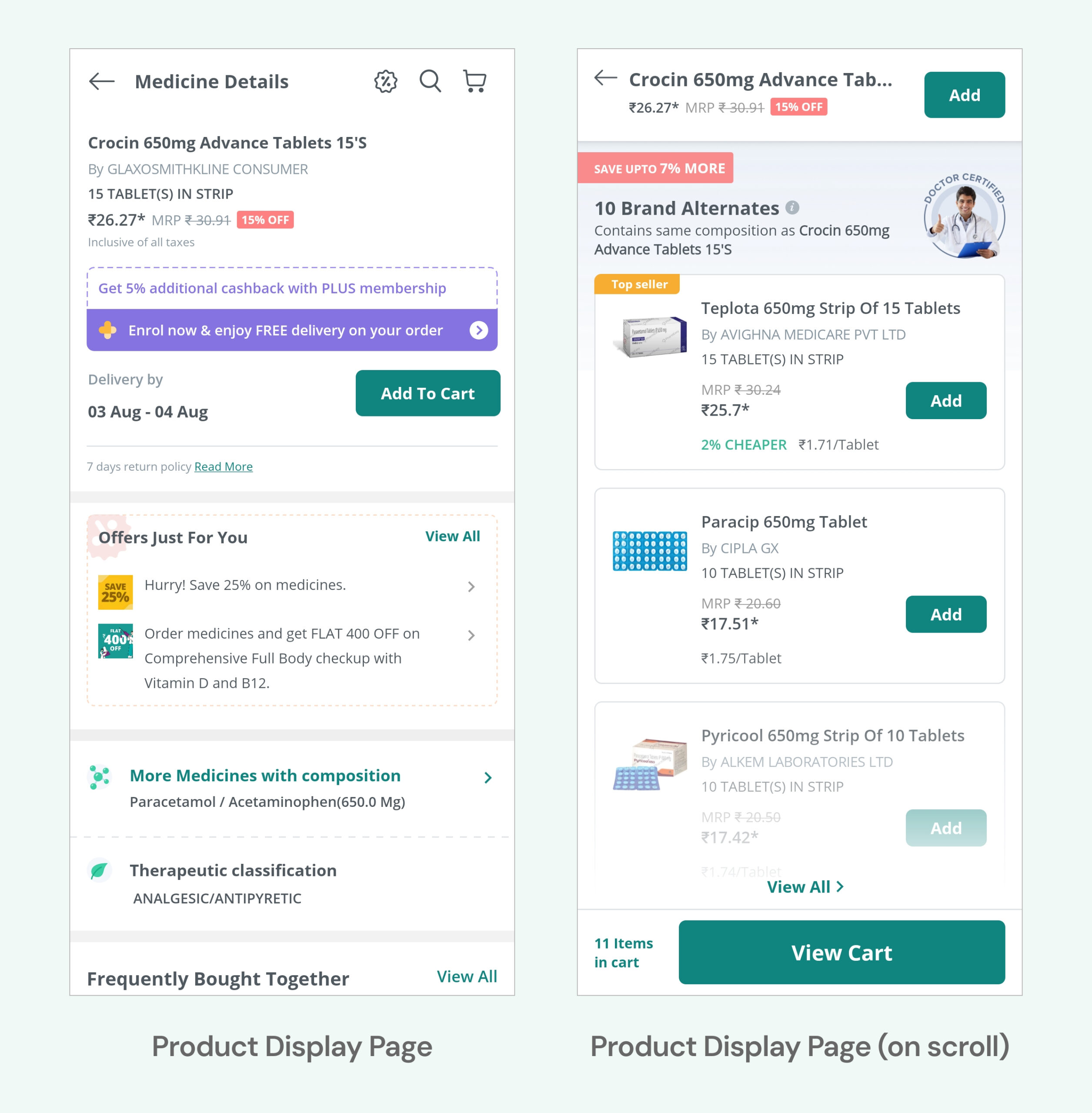

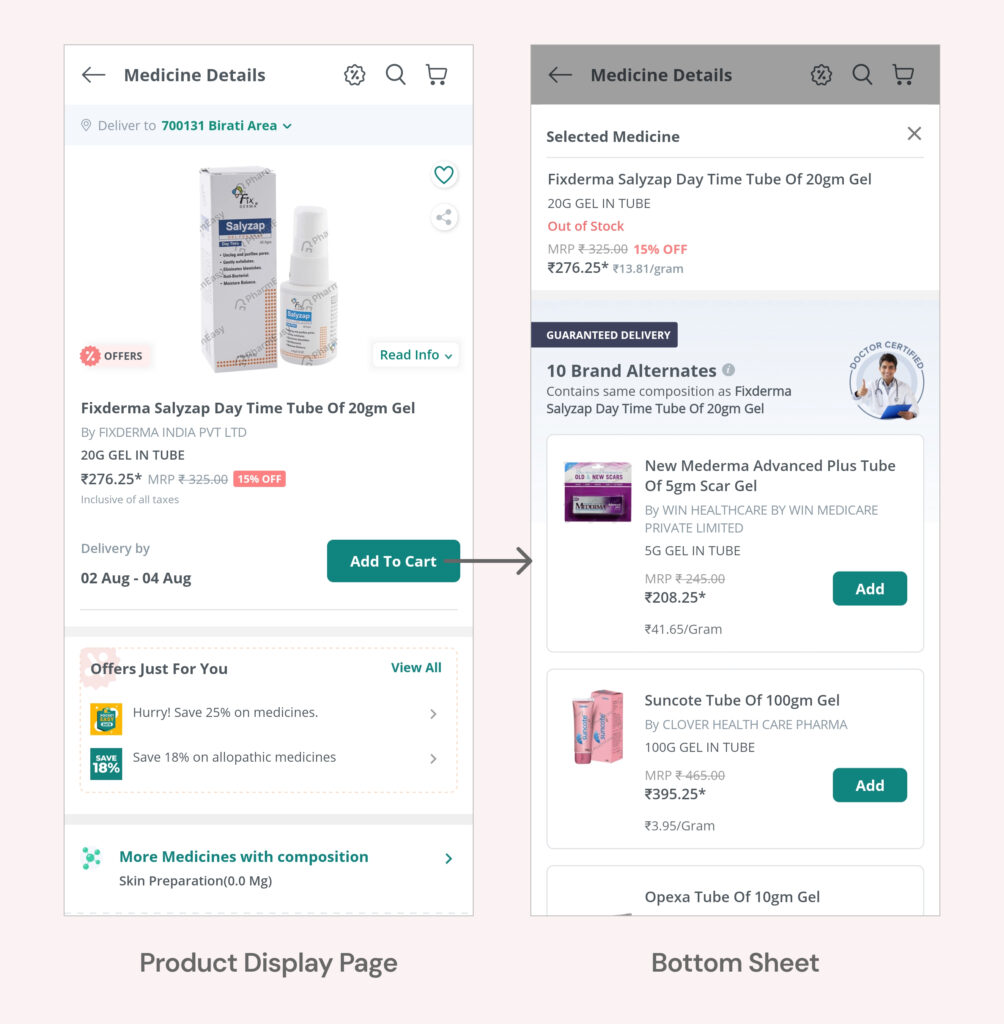

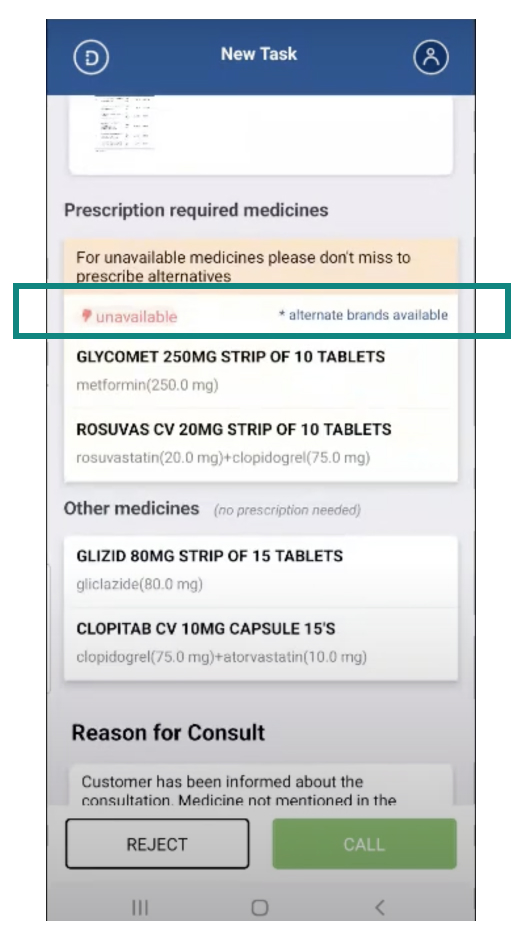

Flip is not always present on the Product Display Page (PDP). It appears only if there are alternates available to it in inventory and Original Medicine falls in any one of the availability criteria

Green Medicine – Readily Available

- User can see that it’s readily available

- Flip is shown on the scroll at Product Display Page (PDP)

Yellow Medicine – Difficult to Procure

- User is not able to see that it’s difficult to procure

- Flip is shown on the bottom sheet while adding the medicine to cart

Red Medicine – Out of Stock

- User can see that it’s out of stock

- Flip is shown on the bottom sheet while adding the medicine to cart

User Medicine Ordering Flow

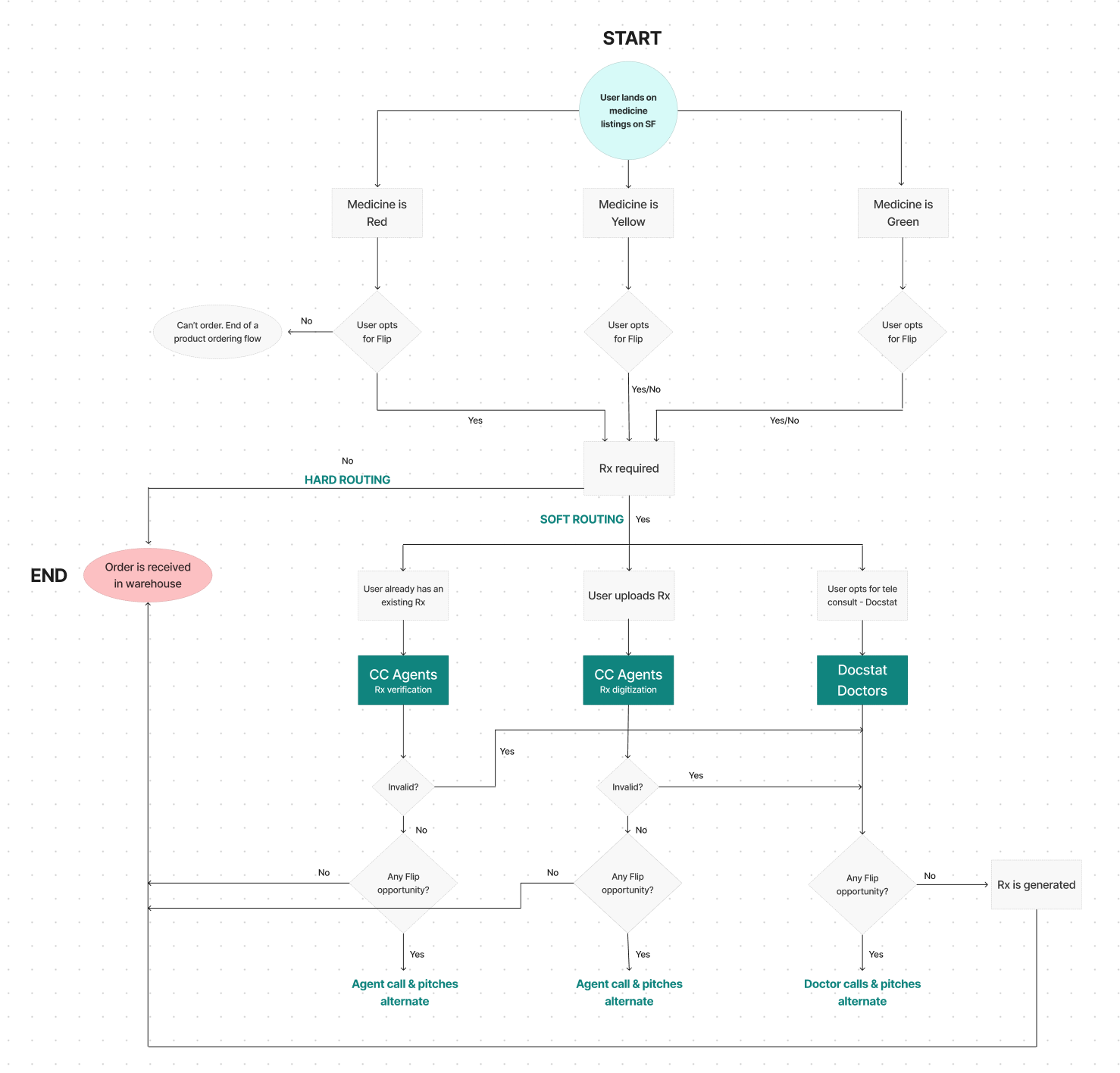

There can be two routes:

- Hard Routing – Order directly goes to warehouse (mostly when Rx is not required) Flip is pitched on Storefront

- Soft Routing – If PE team (CC Agents & Doctors) gets the opportunity to talk to user (mostly when Rx is required) Flip is pitched on Storefront, Customer Care Call and Doctor Call

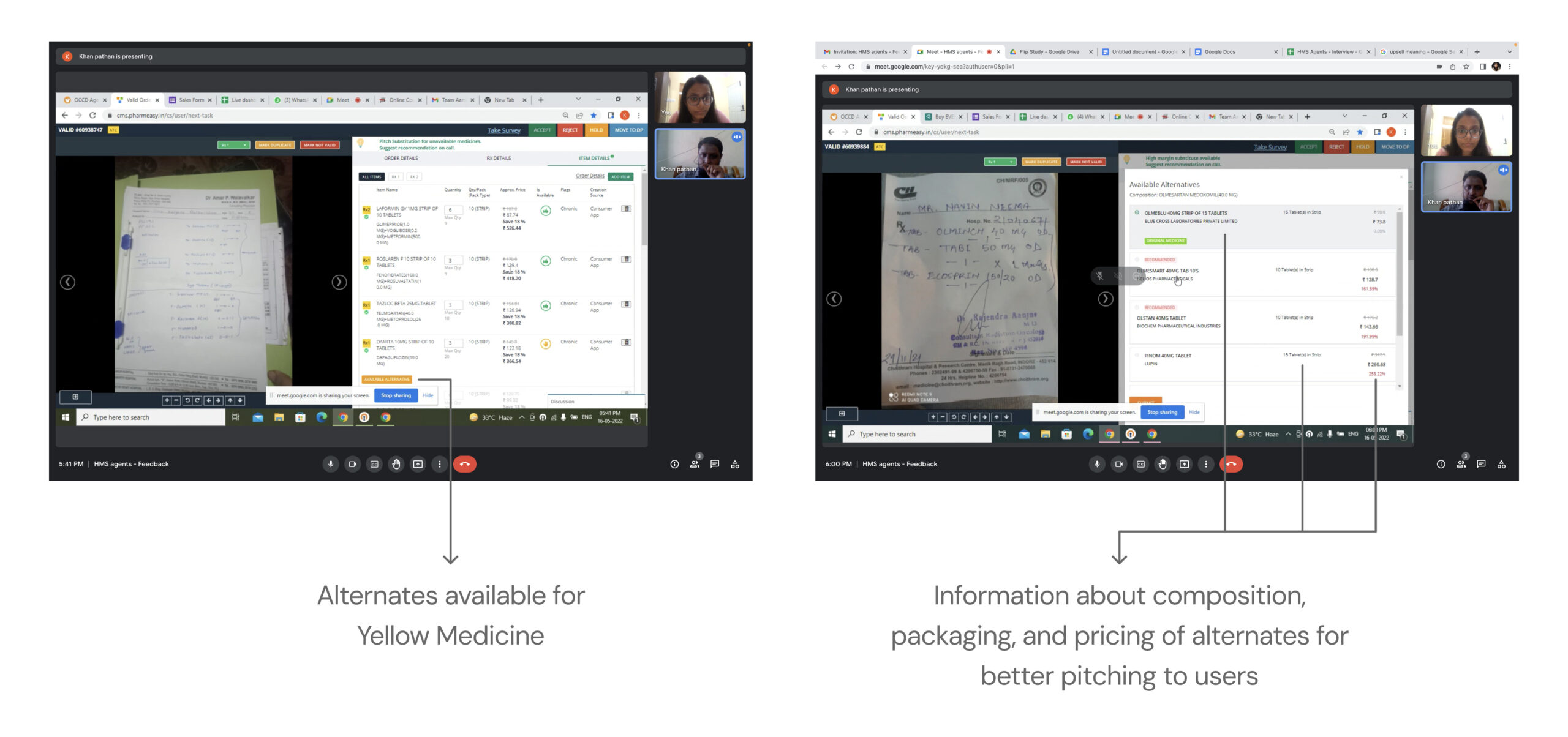

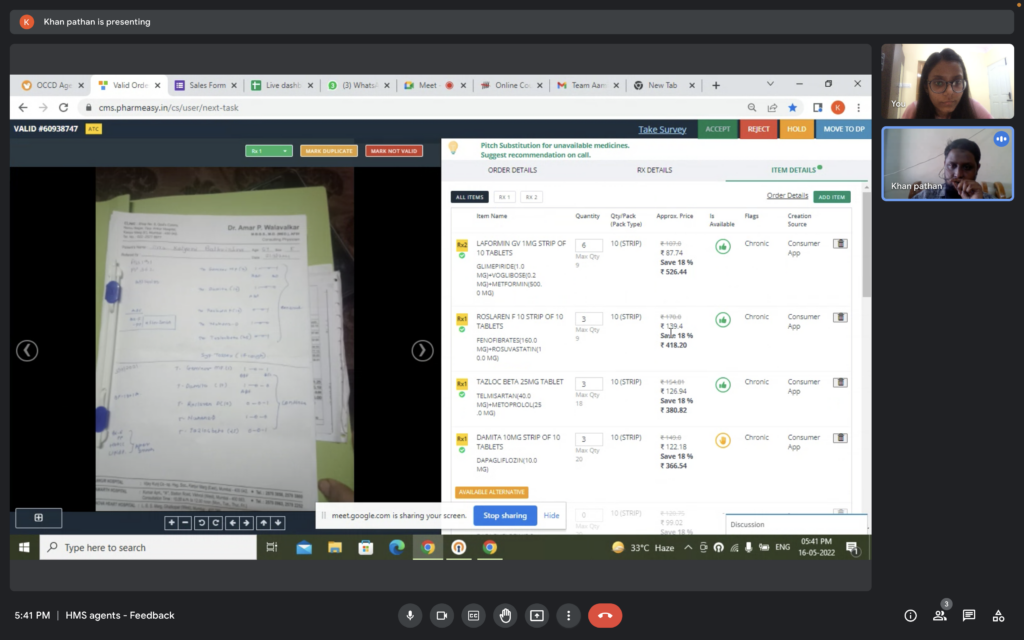

Customer Care Agents Platform

Agents can see the availability tiers of medicine and accordingly prioritize their pitching of alternates to the users. They get incentives for each flipped medicine.

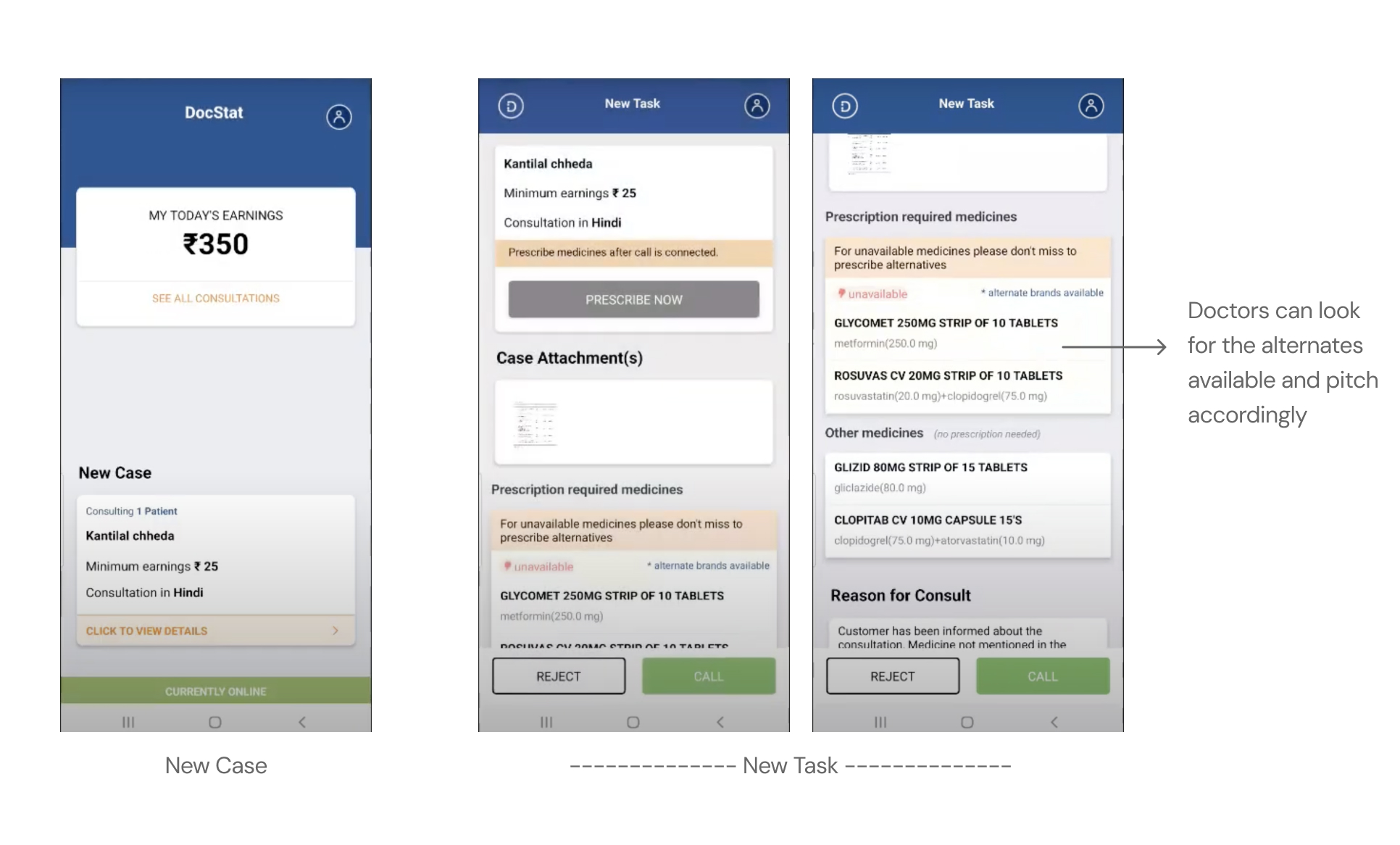

DocStat Platform

DocStat is India’s largest doctor aggregation platform. PharmEasy has tied up with them. Through DocStat, the appointed doctor calls the users to help confirm the prescription.

Research Requirement Document

Received Research Requirement Document in a google form by product team, evaluated it, clarified context in subsequent meetings.

RRD comprised of Business Unit, Sub-Unit, Background of Study, Business Objective, Key Research Questions, POC of all stakeholders involved, Specific areas of interest, Form Factor

- Gathering research requirements from the product team

- Making approach note for the research

- Crafting a research plan mentioning the objectives, considerations, methodology, target group, sample design, logistics

- Defining timelines and outcomes

Business Objective

- Need to improve our margin by selling substitutes

- To increase the value perception with better availability of medicines on the platform

- To improve the retention of users by not letting them drop when their medicine is not available

Research Objective

This research aims to understand user mindset and behavior, in terms of their perception, comprehension, key drivers, and pain points of Flip on PE.

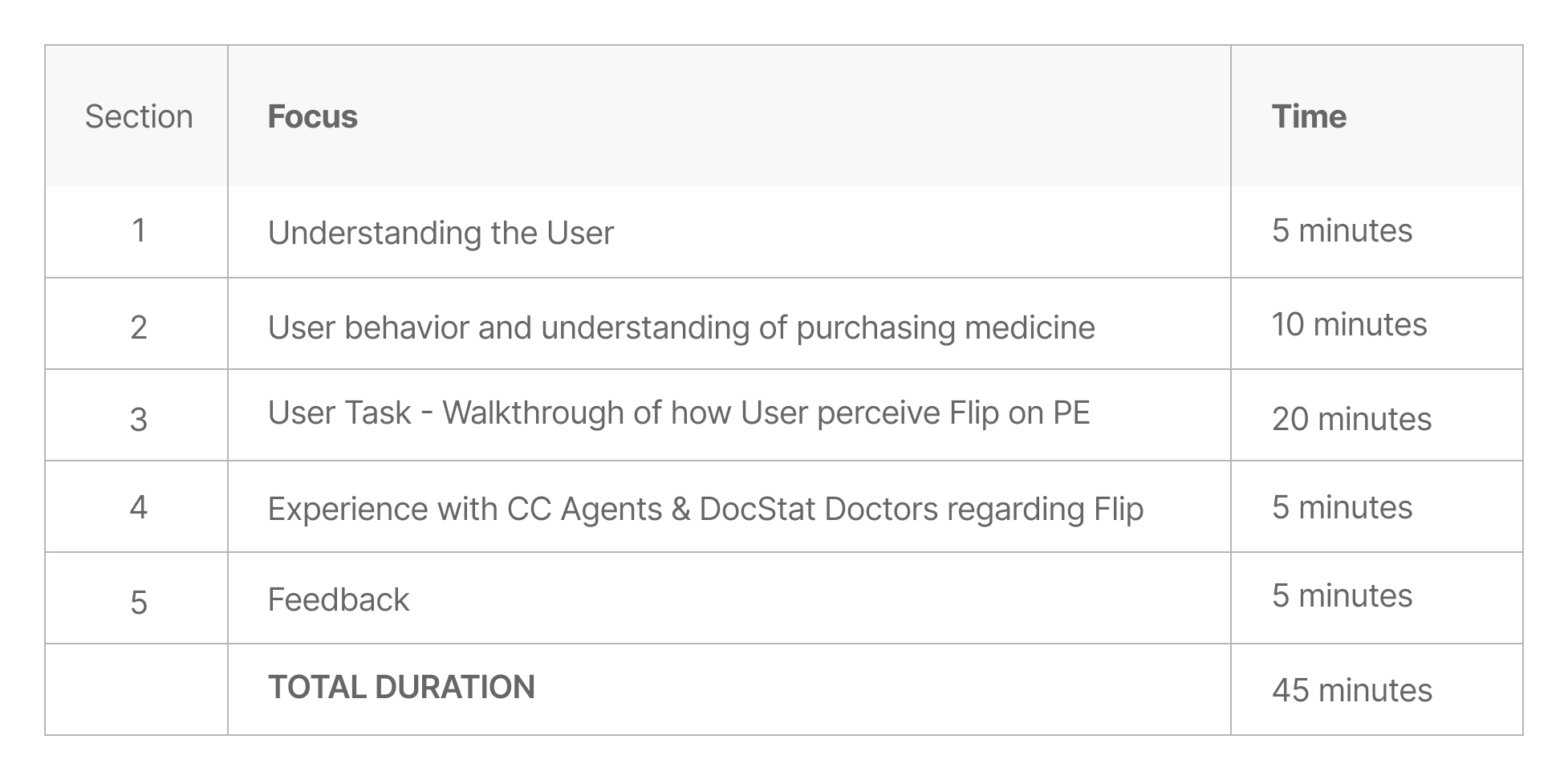

Specific Objectives:

- Understanding the users

- User behavior and understanding of purchasing medicine

- Walkthrough of how User perceive Flip on PE

- Experience with CC & DocStat regarding Flip

- Improvements on PE app screens

Research Consideration

- The major focus is to understand what PE team is doing better where Flip conversion rate is higher and how we can adopt that in our consumer platform screens

- Include users with different product categories (Red, Yellow, or Green) they accept / reject Flip on

PLANNING & DATA COLLECTION

Made a document “Approach note” to share across stakeholders clearly mentioning the process of research, target group, timelines, and logistics.

Research Approach

The research was split into 2 phases:

Phase 1: CC Agents & DocStat Doctors

Conducting interviews with PE agents and doctors

Output: Get patterns out of the queries users come up with and understand their compatibility with the PE agents

Phase 2: User Base

Conducting interviews with PE users

Output: Behavioral & Attitudinal data of users – detailed understanding of user behavior on the app screens

Information Areas

Phase 1: Understanding CC Agents & DocStat Doctors

How do they pitch Brand Alternates?

- Different methods? Examples?

- Terminologies / Jargons / Keyword they use

- Different scenarios for which it’s easier to pitch

Customer’s behavior when Flip is pitched

- Type of queries they get from the customer

- What customers understand and what they don’t

- Does age, gender or geography of customers matter?

Improvements they desire (in Flip & medicine ordering flow)

Phase 2: User Base

Understanding the Users

Introduction, Tech Savviness, Daily Routine, Disease for user order

User behavior of purchasing medicine

Pattern / frequency of ordering, impact of covid, shift from offline to online, other competitors, why PharmEasy, do’s & don’ts while ordering medicine (will help set context for user task), Brands of medicines, Generic medicines, source of information, perception about alternate, flip decision making factors, user’s doctor

User Task – Walkthrough of how user perceive Flip on PE

Task to purchase specific medicine and observe their behavior followed by questions on discoverability, understanding of Brand Alternate section

Experience with CC & DocStat regarding Flip

Past experience, frequency of calls

Improvements on PE app screens

Feedback in general

Research Questions

For Phase 1 Research with CC Agents & DocStat Doctors: Questions were directly asked from Information Areas

For Phase 2 User Base: Based on Information Areas, research questions were designed in “Discussion Guide” for User Base.

Research Methodology & Target Group

Why in-depth interviews?

- To have a direct contact with PE users

- To understand their experiences, opinions, attitudes, perceptions, risk averse factors on Flip

- To observe and collect firsthand personal accounts of their behavior on Flip through User Task

Phase 1: CC Agents & DocStat Doctors

5 Doctors + 5 CC Agents (those who had better Flip conversion rate)

Phase 2: Pharmasy Users

Cohorts:

- New / Power User

- Accepts / Rejects Flip

- Red / Yellow / Green they accept Flip on

- Journey through which they accept / reject Flip

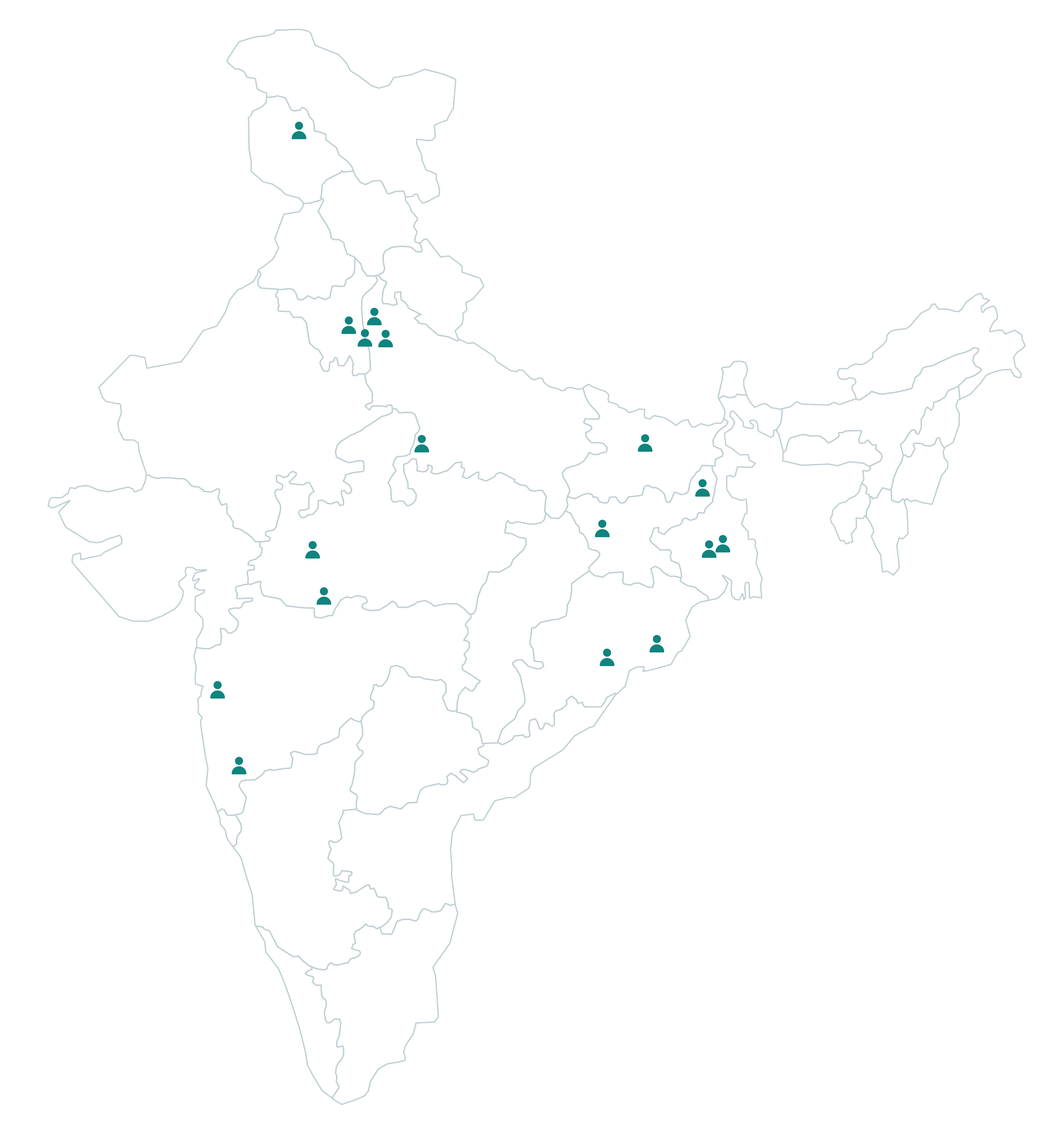

13 Male | 4 Female

2 Tier 1 | 8 Tier 2 | 7 Tier 3

10 Power | 4 Potential Power | 3 Normal

New User: Till the last date of the month in which the user’s first order got fulfilled/delivered

Potential Power User: 1 to 3 orders (Lab test orders are not included as of now, between no specific duration) + ₹1 to ₹999 combined AOV (Average order value) for last orders

Power User: Minimum 4 orders (Lab test orders are not included as of now, between no specific duration) + minimum Rs.1000 combined AOV for last orders + at least one chronic medicine purchased

Sample Design

Operations team had data for agents and doctors with better Flip conversion rate and selected those for the interviews.

Phase 2: Pharmasy Users

Identity:

Customer ID

Name, Pin code

Phone No, Email ID

Association with PE

Months since registration

Customer Type

Average Order Value

Monthly Order Value

Plus Customer (Yes/No)

Flip Behavior in last 6 months

No of Flip Opportunity

No of Flip Converted

No of Red, Yellow, Green Conversion

REPORT

Agents perception of Flip

They are pushed to pitch Brand Alternates seeing the availability of original medicine. For each flipped medicine, they get incentives. They pitch Yellow medicine on priority because if user did not change, delivery of original medicine may get delayed or if not available, deleted.

A few tactics that they follow as told by them:

- Explain Salt & Composition

- Reassurance & Polite Conversation

- Emphasize on Savings

- Emphasize on Better Brand

Doctor perception of Flip

DocStat Doctors don’t understand availability tier of medicines on PharmEasy. They are not aware about medicine being Red, Yellow & Green. On their DocStat platform, medicine is either available or unavailable.

The need has been created in such a way that it seems to work for patient’s benefit. Doctors think that patients have to take their medicines regularly and hence alternates are shown so that patients buy it & do not skip their course.

Hence, doctors don’t for Flip consciously and their conversion rate is comparatively lower than agents.

Docstat Doctors – 11.78 %

CC Agents – 16 %

User’s response to pitching of Flip (as told by CC Agents & DocStat Doctors )

User’s Queries are around

- Brand of alternate medicine

- If it’s a well-known or local brand

- Price of alternate medicine

- How much cheap from the original brand

- If alternate medicine is the same medicine

- Side-effects of alternate medicine

- Availability of original medicine

- Reason of taking order if the original was unavailable

Factors affecting the mindset to Flip

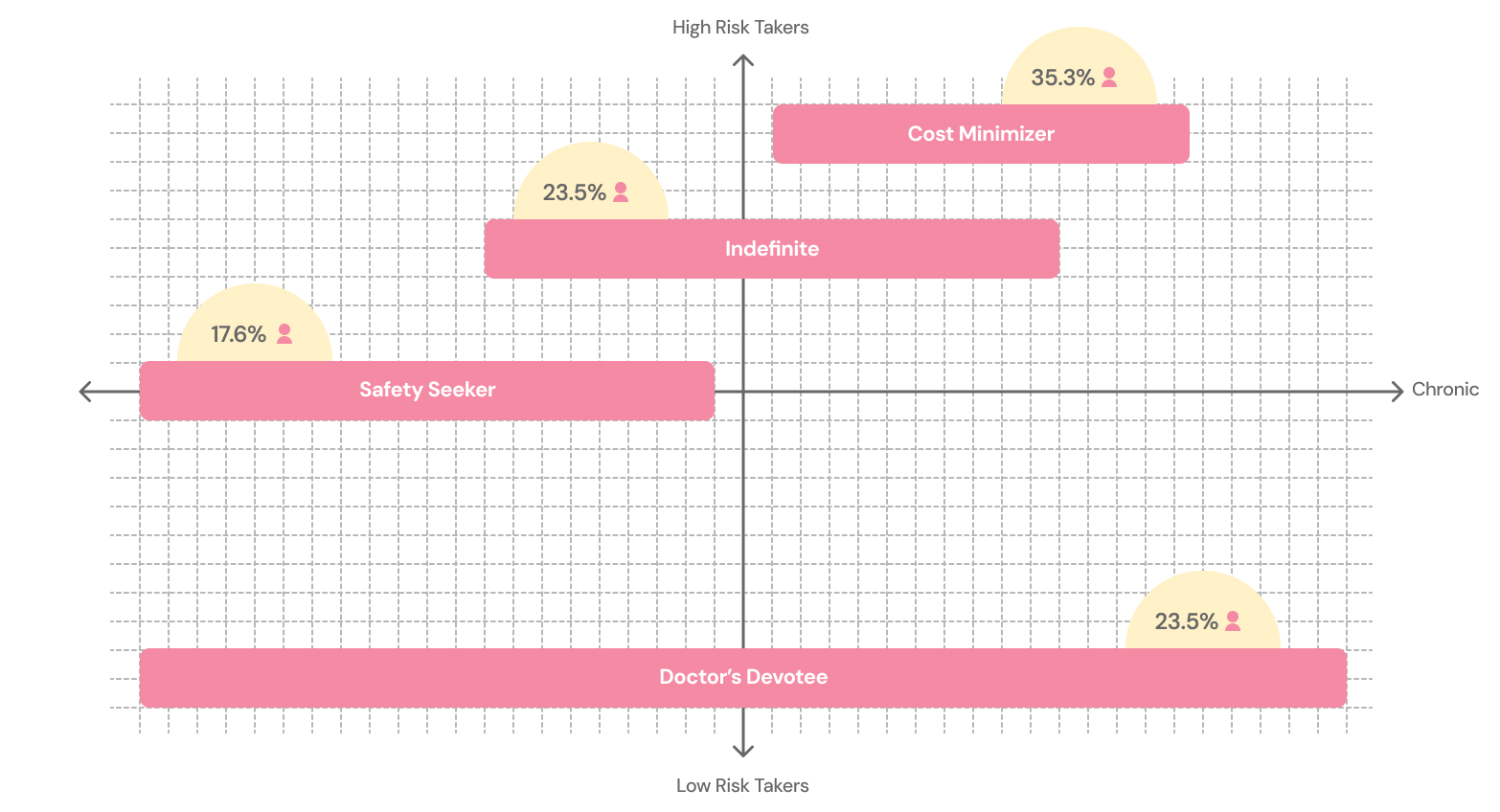

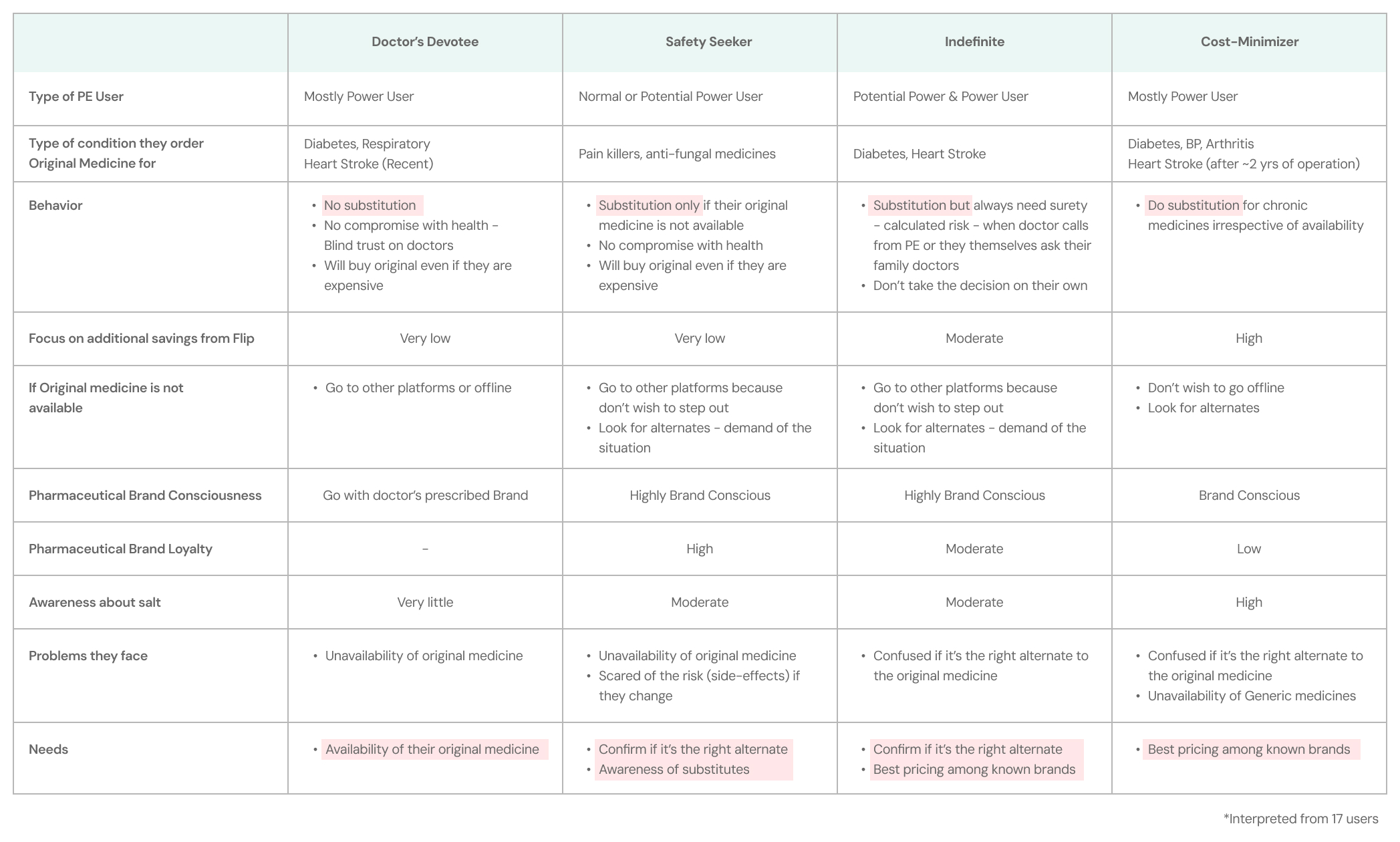

Cohorts

Key Vectors of Cohorts – Intent to Flip depends on 2 key vectors

RISK FACTOR

THERAPEUTIC CLASSIFICATION OF MEDICINE

Plotting of Cohorts

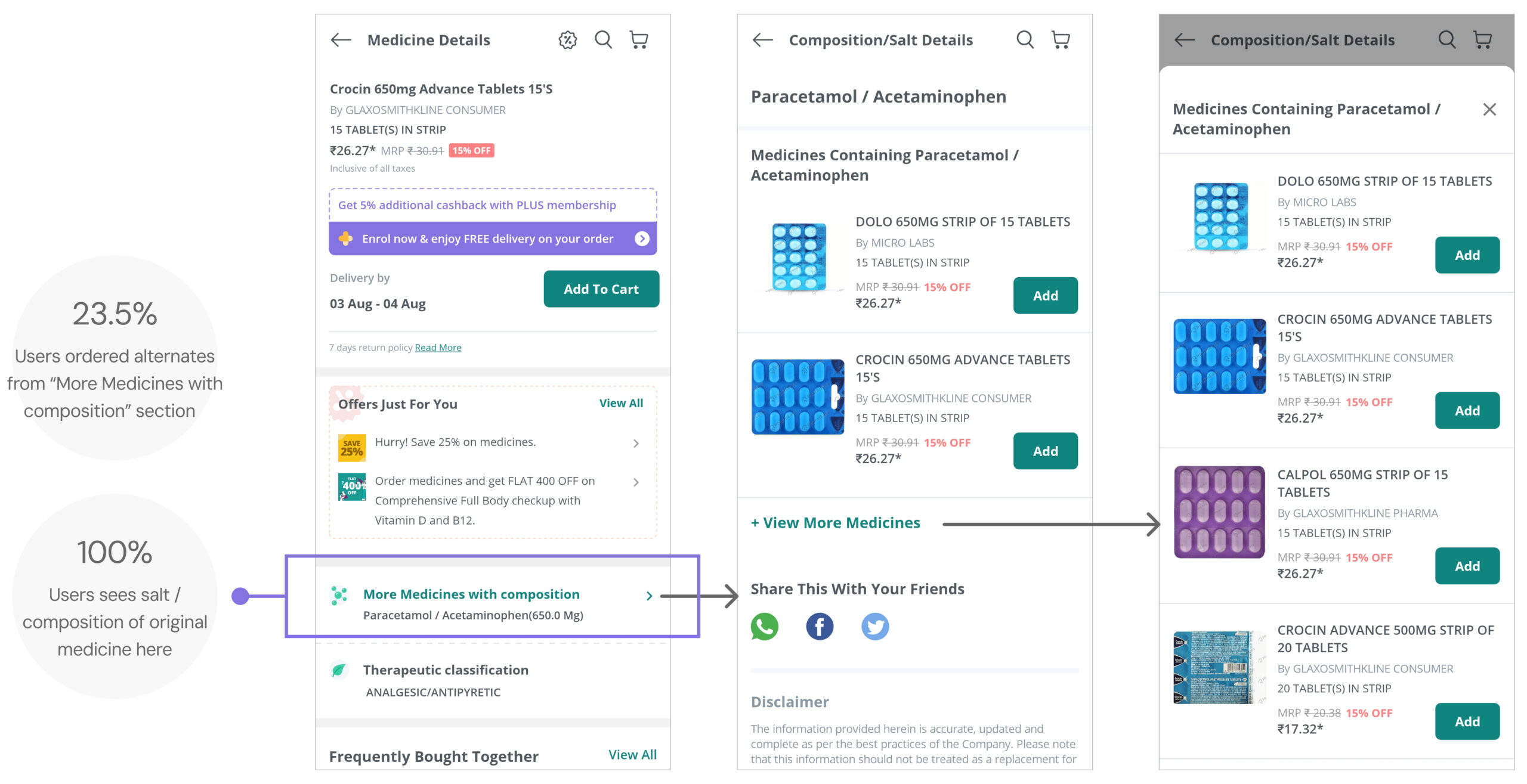

Common Behavior among all cohorts

“More Medicines with Composition” over “Band Alternates”

Why this behavior?

- Familiarity – Have been seeing it from past many years

- Mentally recall it

- Trust – Always present

- Section comes with composition / salt name of medicine

Look for brand of alternate medicine

Users recognize certain brands and have trust on them. Brands which

- are very old & established

- they have seen advertisement of

- their doctors generally pitch

Known & Reputed brand to users

Unknown brand to users

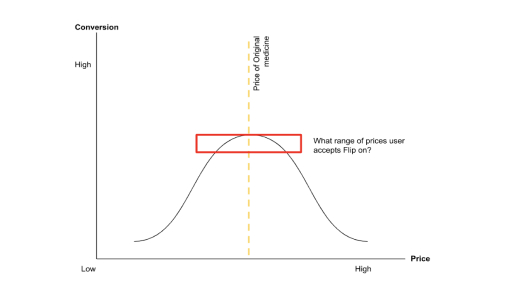

Look for cost of alternate medicine

Cost of alternate medicine w.r.t. the original medicine

- Very high – user never opts

- Very low – user is doubtful (APPLICABLE FOR ALL COHORTS EXCEPT COST MINIMIZER)

Price of Original Medicine: ₹73 / 15 tablets

Price of Alternate Medicine: ₹128.7 / 10 tablets (almost triple price)

Look for cost of original medicine

If original medicine is affordable, then no user wish to change. It defeats the purpose of flipping the medicine.

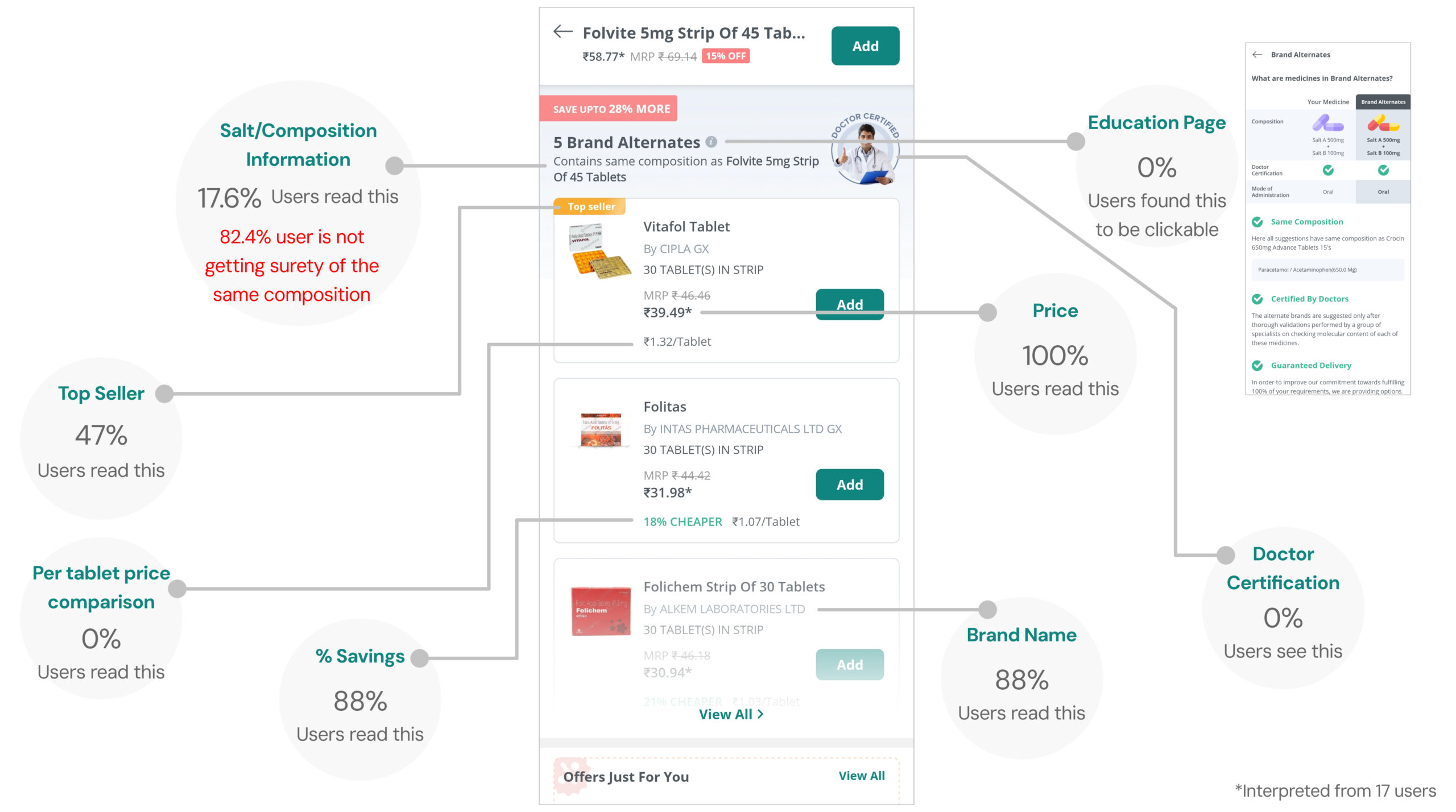

UI Analysis

41.1% Users notices Brand Alternates section either on PDP or bottom sheet

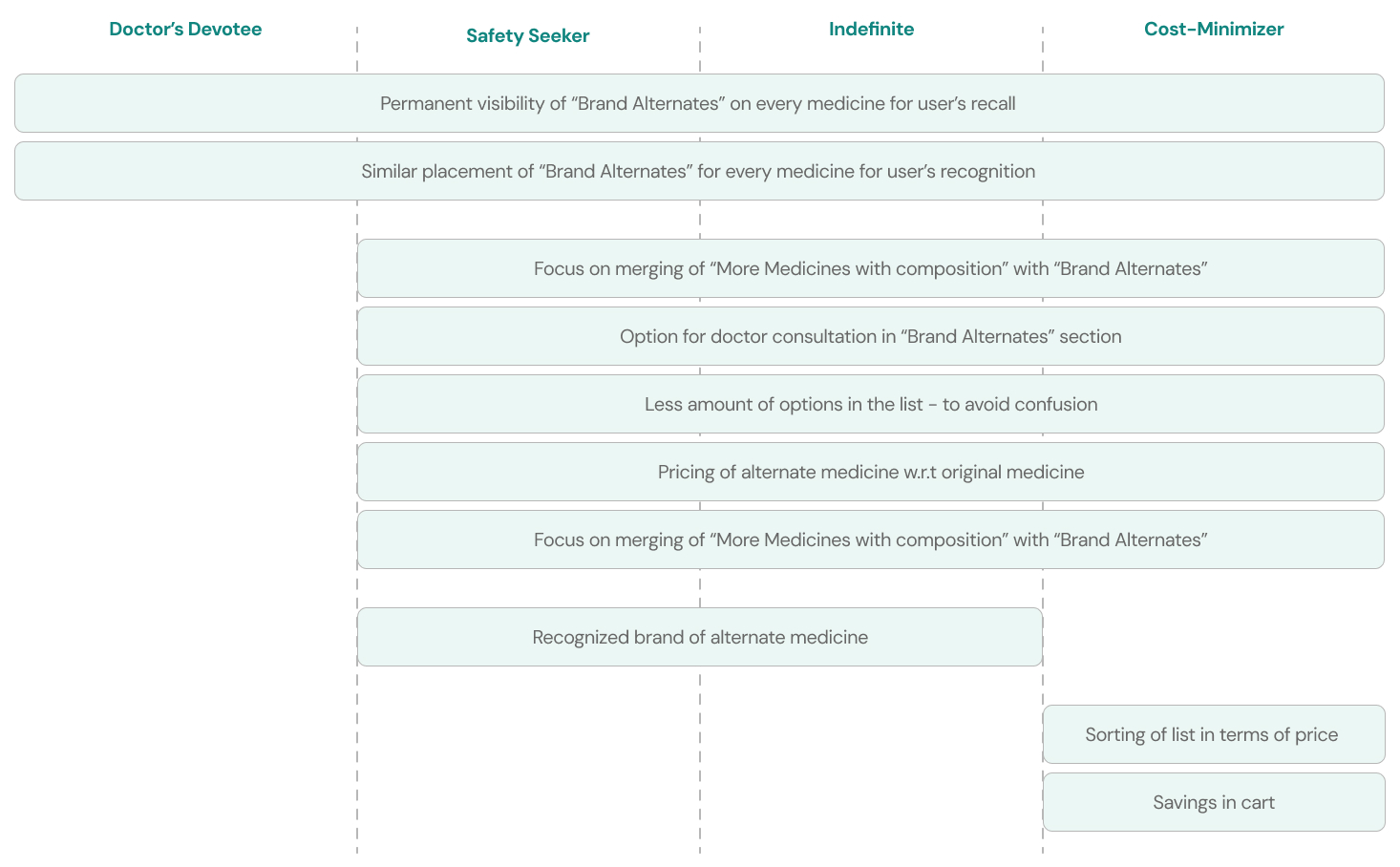

Way Forward

Our cohorts need help as they are in the process of changing their mindset. Revamping of Brand Alternates section can push Flip Decision-Making Factors

There is no “I” in research. Throughout the process we worked transparently, encouraged everyone to participate, draw, code, or share ideas in a format that allows everyone to go on the journey together. Solutioning is not our job, enabling solutioning is. We relinquished the floor to the people who may be best equipped to make a decision.